Buying a house with a partner NZ involves pooling financial resources such as KiwiSaver and First Home Grants while selecting a legal ownership structure that reflects your contributions. Couples must decide between becoming Joint Tenants or Tenants in Common and often require a Contracting Out Agreement to protect individual assets under the Property (Relationships) Act 1976.

Buying a first home is widely considered the “Kiwi Dream,” but in today’s volatile property market, achieving this milestone often requires the combined purchasing power of a couple. While pooling resources makes the deposit hurdle easier to clear, buying a house with a partner in New Zealand introduces a complex web of financial and legal obligations. It is not merely a romantic step forward; it is a binding business transaction that intertwines your financial futures.

From navigating Kāinga Ora eligibility criteria to understanding the nuances of property law, this guide serves as your comprehensive resource for purchasing property together. We will explore how to maximize your deposit using combined KiwiSaver funds, the critical difference between legal titles, and how to protect your assets should the relationship end.

The Financial Advantage: Combining KiwiSaver and Grants

The most significant advantage of buying a house with a partner in NZ is the ability to double your resources. For many first-home buyers, KiwiSaver forms the backbone of the deposit. When you purchase property as a couple, you can combine your eligible withdrawal amounts, potentially adding tens of thousands of dollars to your purchasing power.

KiwiSaver First Home Withdrawal Rules

To utilize your KiwiSaver funds, both partners must meet specific criteria individually. It is possible for one partner to be eligible while the other is not, though ideally, both will contribute. To withdraw funds, you must have been a member of KiwiSaver for at least three years.

You can withdraw almost all of your savings, including:

- Your own contributions.

- Your employer’s contributions.

- The Government annual contribution (member tax credits).

- Interest earned on the account.

However, you must leave a minimum balance of $1,000 in your account. It is also important to note that you cannot withdraw funds transferred from an Australian complying superannuation scheme. You should contact your KiwiSaver provider early in the process to apply for a pre-approval letter, which confirms exactly how much you can contribute toward the deposit.

Understanding the First Home Grant for Couples

Beyond your own savings, eligible couples may qualify for the First Home Grant, administered by Kāinga Ora. This grant provides distinct financial assistance depending on whether you are buying an existing home or a new build.

Grant Caps and Income Limits

As of the current regulations, the grant offers up to $5,000 per person for an existing home (based on $1,000 for each year of contribution) or up to $10,000 per person for a new build. This means a couple could potentially receive up to $20,000 free from the government toward their deposit.

However, strict income caps apply. To be eligible as a couple buying a house with a partner in NZ, your combined annual income before tax must be $150,000 or less in the last 12 months. If your combined income exceeds this threshold, you will not be eligible for the grant, although you can still utilize your KiwiSaver withdrawal.

Furthermore, house price caps apply depending on the region you are buying in. These caps are reviewed periodically to reflect market changes. It is vital to check the Kāinga Ora website for the most up-to-date price caps for your specific region, as purchasing a property above these limits will disqualify you from the grant.

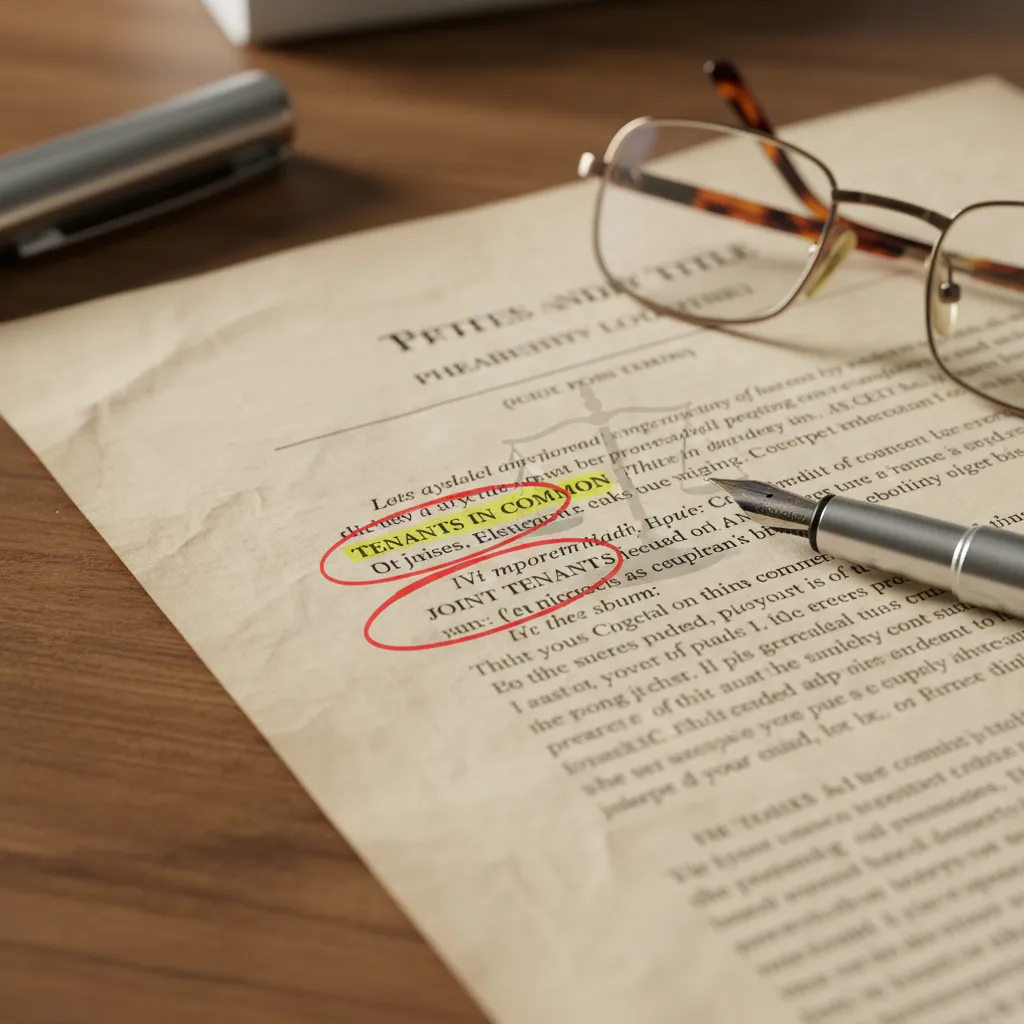

Legal Structures: Joint Tenants vs. Tenants in Common

Once the financing is secured, you must instruct your solicitor on how you wish to hold the title to the property. In New Zealand law, there are two primary ways to own property with a partner: Joint Tenants and Tenants in Common. This decision has massive implications for your estate and separation rights.

Option 1: Joint Tenants

This is the traditional structure for married couples or long-term partners. Under a Joint Tenancy, you do not own distinct shares of the property; instead, you both own the whole property together. The defining feature of this structure is the Right of Survivorship.

If one partner passes away, their interest in the property automatically passes to the surviving partner, regardless of what is written in the deceased partner’s will. This structure implies equal ownership and is often the default choice for couples contributing equally to the deposit and mortgage.

Option 2: Tenants in Common

Tenants in Common is a structure where each partner owns a distinct share of the property. These shares can be equal (50/50) or unequal (e.g., 70/30 or 60/40). This is the preferred option when one partner contributes a significantly larger deposit than the other.

Crucially, there is no Right of Survivorship. If one partner dies, their share of the property is distributed according to their will. This allows a partner to leave their share of the house to children from a previous relationship or other family members, rather than it automatically going to the surviving partner.

The Property (Relationships) Act 1976 Explained

Regardless of which title structure you choose, the Property (Relationships) Act 1976 (PRA) overrides many private arrangements once a relationship has lasted for three years. In New Zealand, the family home is considered “relationship property.”

The Equal Sharing Rule

Under the PRA, if you have lived together as a couple (de facto, civil union, or married) for three years or more, the general rule is that all relationship property is divided 50/50 if you separate. This applies even if one partner paid the entire deposit and serviced the majority of the mortgage.

This law is designed to recognize non-financial contributions to a relationship, such as raising children or managing the household. However, for couples buying a house with a partner in NZ where financial contributions are vastly unequal, this can be a source of significant anxiety.

Protecting Unequal Contributions: The Contracting Out Agreement

If you wish to opt out of the PRA’s equal sharing rules, you must sign a Contracting Out Agreement (often referred to as a “prenup” or “Section 21 agreement”). This legal document allows you to define exactly how the property should be divided if you separate.

Why You Might Need One

Imagine Partner A contributes $100,000 from an inheritance toward the deposit, and Partner B contributes $10,000 from KiwiSaver. Without an agreement, after three years, Partner B could be entitled to half of the home’s total equity, effectively absorbing a portion of Partner A’s initial investment.

A Contracting Out Agreement can stipulate that in the event of a sale or separation, Partner A gets their $100,000 back first, and the remaining profit is split 50/50 (or any other ratio). For the agreement to be legally binding:

- It must be in writing.

- Both parties must get independent legal advice from different lawyers.

- The lawyers must certify that they have explained the effects and implications of the agreement.

While discussing a “breakup plan” while buying a dream home can feel unromantic, it is a prudent financial step recommended by most property lawyers in New Zealand.

What Happens to the House if You Separate?

Separation is a difficult reality that affects property ownership. If you break up, the house usually needs to be dealt with in one of three ways:

- Buyout: One partner buys the other out. This requires the remaining partner to have enough income to service the mortgage alone and enough cash (or equity) to pay the exiting partner their share.

- Open Market Sale: The property is sold, the mortgage is repaid to the bank, and the remaining proceeds are divided according to your legal agreement (or the PRA default of 50/50).

- Continued Co-ownership: In rare cases, ex-partners continue to own the property as an investment, though this is fraught with complications regarding maintenance costs and future capital gains.

If you used KiwiSaver to buy the house, you generally do not have to pay it back to the provider upon sale. However, the Kainga Ora First Home Grant may have a “clawback” clause if you sell the property within a certain timeframe (usually 6 months to 5 years depending on when you bought it), requiring you to repay the grant.

Step-by-Step Checklist for Buying Together

To ensure a smooth process when buying a house with a partner in NZ, follow this chronological checklist:

- Step 1: Financial Health Check. Review credit scores and debts. Be honest about student loans and hire purchases, as these affect borrowing power.

- Step 2: KiwiSaver & Grant Pre-approval. Contact your providers and Kainga Ora to get written confirmation of your available funds.

- Step 3: Mortgage Pre-approval. Visit a mortgage broker or bank to determine your borrowing capacity as a couple.

- Step 4: Engage a Solicitor. Find a lawyer who specializes in conveyancing and relationship property. Discuss the “Contracting Out Agreement” early.

- Step 5: House Hunting. Attend open homes and auctions. Keep your price caps in mind if using the First Home Grant.

- Step 6: Due Diligence. Get a LIM report and a builder’s report. Never skip this step.

- Step 7: Sign the Agreement. Decide on “Joint Tenants” or “Tenants in Common” before the settlement date.

- Step 8: Settlement. The bank releases funds, the lawyers transfer the title, and you get the keys.

For more detailed information on property legislation, you can refer to the Property (Relationships) Act 1976 via the New Zealand Legislation website.

Buying a house with a partner is a journey that requires transparency, legal foresight, and financial discipline. By addressing the difficult questions regarding ownership structures and separation contingencies upfront, you can enjoy your new home with the peace of mind that both your relationship and your assets are built on a solid foundation.

People Also Ask

Can I buy a house with my partner if only one of us is a first home buyer?

Yes, you can buy a house together. The partner who is a first home buyer can use their KiwiSaver and apply for the First Home Grant (if eligible). The other partner cannot access the first-home assistance but can still be a co-owner and contribute to the mortgage.

What happens if we separate before 3 years of living together?

If you have lived together for less than three years, the Property (Relationships) Act usually considers this a relationship of short duration. Typically, assets are divided based on financial contributions rather than a 50/50 split, but this can be contested legally if there is a child involved.

Do we need a lawyer to buy a house together in NZ?

Yes, you cannot complete a property transaction in New Zealand without a lawyer or conveyancer. They are required to handle the transfer of the title, the mortgage documentation, and the release of KiwiSaver funds.

Can we use KiwiSaver for a deposit on an investment property?

No, KiwiSaver withdrawal is strictly for purchasing a home that you intend to live in as your principal place of residence. You generally must live in the property for at least six months after settlement.

Is a Contracting Out Agreement binding in court?

Yes, provided it meets the certification requirements (written, signed, independent legal advice). However, a court can set it aside if it determines that enforcing the agreement would cause a “serious injustice,” though this is a high threshold to meet.

How much deposit do we need as a couple?

Most banks require a 20% deposit. However, first home buyers can often access loans with only a 5% deposit through the First Home Loan scheme if they meet income and price cap criteria.