A de facto relationship NZ is defined under the Property (Relationships) Act 1976 as a relationship between two people who are both 18 years or older, live together as a couple, and are not married or in a civil union with one another. Once this relationship endures for three years, the law generally requires relationship property to be divided equally between partners upon separation.

What is a De Facto Relationship in NZ Law?

In New Zealand, the legal landscape regarding relationships and property is governed primarily by the Property (Relationships) Act 1976 (PRA). While marriage and civil unions are formalised via registration, a de facto relationship is a question of fact. It exists when two people live together as a couple.

Many New Zealanders mistakenly believe that “common law” marriage implies you must live together for a decade before rights accrue. This is incorrect. The threshold in New Zealand is significantly lower, and the implications are profound. The law applies equally to opposite-sex and same-sex couples.

The Legal Definition Under the Act

According to Section 2D of the PRA, determining whether two people are living together as a couple requires an assessment of all the circumstances of the relationship. There is no single factor that is necessary or sufficient to prove the relationship exists; rather, it is a cumulative assessment.

The Court considers the following specific factors:

- Duration: The length of the relationship.

- Residence: The nature and extent of common residence (living under the same roof).

- Sexual Relationship: Whether a sexual relationship exists.

- Financial Dependence: The degree of financial dependence or interdependence, and any arrangements for financial support.

- Property Ownership: The ownership, use, and acquisition of property.

- Commitment: The degree of mutual commitment to a shared life.

- Children: The care and support of children.

- Public Reputation: The reputation and public aspects of the relationship (i.e., do friends and family view you as a couple?).

It is important to note that you can maintain separate bank accounts and even spend some nights apart and still be considered to be in a de facto relationship. The courts look at the substance of the partnership, not just the technicalities.

The Significance of the 3-Year Rule

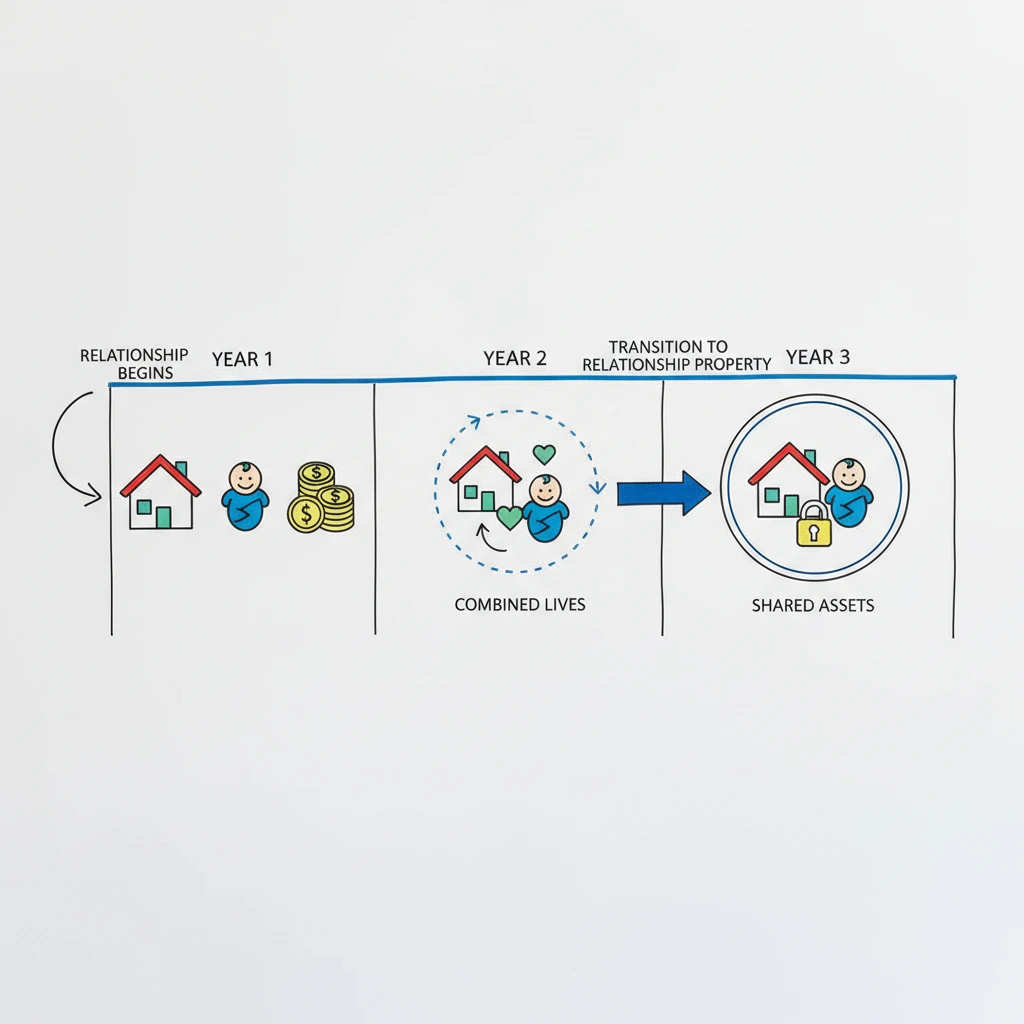

The “3-Year Rule” is the most critical concept to understand within New Zealand relationship property law. It serves as the tipping point between two vastly different legal regimes regarding asset division.

Once a de facto relationship has lasted for three years or more, it falls under the standard provisions of the PRA. This triggers the equal sharing principle. Under this principle, all “relationship property” is generally divided 50/50 if the couple separates or if one partner dies.

This includes:

- The family home (regardless of when it was bought or who paid for it, if it is used as the family home).

- Family chattels (furniture, cars, boats).

- Income earned during the relationship.

- KiwiSaver and superannuation accumulated during the relationship.

- Debts incurred for the benefit of the relationship.

Before the three-year mark, the presumption of equal sharing does not typically apply. However, once that clock ticks past three years, a partner who owned a house prior to the relationship could legally lose half of its value to their de facto partner upon separation, absent a legal agreement stating otherwise.

Relationships of Short Duration: Less Than 3 Years

A relationship that has lasted less than three years is legally classified as a “relationship of short duration.” Generally, the Property (Relationships) Act treats these differently. In a short-duration relationship, the equal sharing regime usually does not apply.

Instead, assets are typically divided based on contributions. This means:

- If you owned the house before the relationship, you generally keep the house.

- If you kept your finances separate, you generally leave with what is yours.

- Property is divided in proportion to the contribution each partner made to the marriage or civil union or de facto relationship.

However, this is not a blanket immunity. As detailed below, specific exceptions can accelerate a couple into a property-sharing arrangement even if they have been together for less than three years.

Exceptions: When Short Relationships Qualify for Division

There are scenarios where the court will set aside the “short duration” exemption and apply property sharing rules, although the division may not necessarily be 50/50—it is often determined by contribution. These exceptions are found in Section 14A of the Act.

The court may make an order for division in a relationship of short duration if:

1. There is a Child of the Relationship

If the couple has a child together, the court is much more likely to intervene. The definition of a “child of the relationship” is broad. It includes biological children, adopted children, and even children from previous relationships if they lived in the household and were treated as members of the family.

The mere existence of a child does not automatically trigger 50/50 sharing. However, if the court determines that a serious injustice would occur if the order were not made, they will proceed with a division of property based on contributions.

2. Significant Contributions

The second exception applies if the applicant has made a “substantial contribution” to the relationship. Contributions are not limited to money. They can include:

- Management of the household.

- Care of children.

- Forging a career to look after the home.

- Paying for renovations or paying down the mortgage of a partner’s home.

3. The Serious Injustice Test

For either of the above exceptions to apply, the court must be satisfied that failing to make an order would result in a serious injustice. This is a high bar, but it is frequently met in cases where one partner has sacrificed their career or financial position for the relationship, or where one partner has significantly increased the value of the other’s assets.

Property Division: What Assets Are at Risk?

Understanding the distinction between Relationship Property and Separate Property is vital for anyone in a de facto relationship in New Zealand.

Relationship Property

This is the pool of assets that gets divided. It typically includes:

- The Family Home: Even if one person owned it 20 years before the relationship started, if it becomes the principal family residence, it usually becomes relationship property after three years.

- Family Chattels: Household furniture, appliances, and vehicles used for family purposes.

- Acquired Assets: Any property acquired by either party during the relationship.

- Income: Salary, wages, and business income earned during the relationship.

- KiwiSaver: The portion of KiwiSaver or superannuation accumulated from the start date of the de facto relationship until separation.

Separate Property

Separate property generally remains with the original owner and is not shared. This includes:

- Property acquired before the relationship (excluding the family home and chattels).

- Heirlooms and taonga.

- Inheritances and gifts from third parties (provided they are kept separate and not intermingled).

Warning on Intermingling: Separate property can become relationship property if it is “intermingled.” For example, if you receive an inheritance of $50,000 and use it to pay down the mortgage on the family home, that money likely becomes relationship property and cannot be easily reclaimed.

Proving a De Facto Relationship Exists

Disputes often arise regarding the start date of the relationship. One partner may claim they were just “dating” for the first two years, while the other claims they were living together as a couple. Because the 3-year threshold is so powerful, establishing the exact date cohabitation began is crucial.

Evidence used to prove a de facto relationship includes:

- Tenancy agreements or property titles with both names.

- Joint bank account records.

- Utility bills addressed to both parties at the same address.

- Text messages, emails, and social media posts indicating a shared life.

- Witness statements from friends and family regarding the public nature of the relationship.

- School records for children listing both partners as guardians/contacts.

For authoritative guidance on these factors, you can refer to the Property (Relationships) Act 1976 via legislation.govt.nz.

Protecting Assets: Contracting Out Agreements

If the default rules of the PRA do not suit your situation—for example, if you are bringing a mortgage-free home into a new relationship—you can opt out of the Act. This is done through a Contracting Out Agreement, commonly known in New Zealand as a “Section 21 Agreement” or a prenup.

What is a Section 21 Agreement?

This is a written agreement where a couple decides how their property will be divided if they separate or if one of them dies, rather than following the 50/50 rule of the Act. You can ring-fence specific assets (like a house, business, or inheritance) as separate property.

Requirements for Validity

For a Contracting Out Agreement to be legally binding, strict procedural requirements must be met:

- The agreement must be in writing and signed by both parties.

- Each party must have independent legal advice from a separate lawyer.

- The signature of each party must be witnessed by their lawyer.

- The lawyer must certify that they have explained the effects and implications of the agreement to their client.

If these steps are not followed, the court can declare the agreement void. Furthermore, if the agreement becomes “seriously unjust” over time (e.g., after 20 years and three children, one partner is left with nothing), the court has the power to set it aside, though this is relatively rare for well-drafted agreements.

Conclusion

The concept of a de facto relationship in NZ carries significant legal weight. The transition from a casual partner to a de facto spouse can happen without a ceremony or a certificate, yet it binds you to the same property sharing laws as a marriage after three years.

Whether you are entering a new relationship with assets you wish to protect, or you are separating and seeking a fair share of the life you built together, understanding the nuances of the 3-year rule is essential. Because the Property (Relationships) Act focuses on the substance of the relationship rather than the title, it is always advisable to seek legal advice early to understand your specific rights and obligations.

For more information on family justice and legal proceedings, visit the New Zealand Ministry of Justice website.

Frequently Asked Questions

What qualifies as a de facto relationship in NZ?

A de facto relationship in NZ qualifies when two people aged 18 or older live together as a couple. Factors include living arrangements, sexual relationship, financial interdependence, mutual commitment, and public reputation. It applies to both same-sex and opposite-sex couples.

Does a de facto partner get half the house in NZ?

Generally, yes, if the relationship has lasted for three years or more. Under the Property (Relationships) Act 1976, the family home is usually considered relationship property and is divided 50/50 upon separation, regardless of who paid for it, unless a Contracting Out Agreement exists.

What is the 3-year rule for relationships in NZ?

The 3-year rule dictates that once a de facto relationship exceeds three years in duration, the equal sharing principle applies. This means relationship property (including the family home and income) is generally divided equally between partners if they separate.

Can a girlfriend claim half your house after 2 years?

Usually, no. A relationship of less than three years is considered of “short duration,” and assets are typically divided based on contributions. However, exceptions exist if there is a child of the relationship or if she made substantial contributions, and a serious injustice would otherwise occur.

How do I prove I am in a de facto relationship?

Proof involves providing evidence of a shared life, such as joint bank accounts, tenancy agreements, shared utility bills, correspondence (texts/emails), evidence of a sexual relationship, and witness statements from associates confirming you presented yourselves as a couple.

Is a contracting out agreement binding?

Yes, a Contracting Out Agreement (prenup) is binding if it meets Section 21F requirements: it must be in writing, signed by both parties, and both parties must have received independent legal advice with their lawyers witnessing the signatures and certifying the advice given.