A money conversation dating strategy involves proactively discussing financial habits, debt loads, and income disparities early in a relationship to establish trust and compatibility. In the New Zealand context, successfully navigating this topic requires balancing cultural reserve with the legal realities of de facto relationships, ensuring both partners are financially aligned before assets merge.

The Kiwi Taboo: Why We Struggle to Talk Cash

In New Zealand, we are famous for our ingenuity, our hospitality, and our stunning landscapes. However, we are equally infamous for our reluctance to discuss money. Culturally, Kiwis often view financial discussions as gauche or overly aggressive. This stems from a mix of British colonial reserve and the “Tall Poppy Syndrome,” where discussing wealth can be seen as boasting, and discussing debt can be seen as a failure.

This cultural silence creates a significant barrier in the dating world. While it is acceptable to discuss politics, religion, or past relationships relatively early, asking a potential partner about their student loan balance or credit card debt is often viewed as a major faux pas. Yet, avoiding the money conversation dating phase is a luxury we can no longer afford.

With the cost of living rising in major hubs like Auckland and Wellington, and the housing market presenting a formidable challenge for young couples, financial compatibility is just as important as romantic chemistry. Ignoring the financial elephant in the room does not make it disappear; it simply allows it to grow until it threatens the stability of the relationship. To build a durable partnership, couples must unlearn the habit of silence and view financial transparency as an act of intimacy, not an interrogation.

Timing the Talk: When to Break the Silence

Determining exactly when to introduce financial topics can be tricky. Bring it up on the first date, and you may appear mercenary or transactional. Wait until you are signing a lease together, and you may find yourself legally bound to a financial disaster. The key is a graduated approach that matches the seriousness of the relationship.

The Early Dates (0–3 Months)

In the initial stages, you do not need to demand bank statements. However, you should be observing financial behaviors. Does your date suggest expensive outings they clearly cannot afford? Are they rude to waitstaff regarding the bill? These are early indicators of their money mindset. You can drop subtle hints about your own values, such as, “I’m trying to save for a trip to Queenstown later this year, so I’m watching my spending this month.” This signals that you are financially responsible without making it a heavy topic.

The “Exclusive” Phase (3–6 Months)

Once you decide to be exclusive, the conversation should deepen. This is the time to discuss broad financial goals. Do you want to own a home one day? Do you prioritize travel over material goods? This is also the appropriate time to disclose significant financial obligations that might impact your ability to participate in the relationship, such as heavy student loans or child support payments.

Pre-Cohabitation (6 Months – 1 Year)

Before you move in together, full disclosure is mandatory. In New Zealand, moving in together starts the clock on the de facto relationship timeline (more on this in the legal section). At this stage, you must know exactly what the other person earns, what they owe, and what their credit history looks like. Moving in together without this knowledge is akin to signing a business contract without reading the terms.

Scripts for Success: Bringing Up Income and Debt Gently

Initiating the money conversation dating talk is often the hardest part. Many people fear being judged or causing a fight. The best strategy is to frame the conversation around shared goals rather than past mistakes. By using “I” statements, you reduce defensiveness.

Opening the Door

Try starting with vulnerability. You might say, “I’ve been thinking a lot about my future financial goals lately, and I’m trying to get a handle on my student loan. I’d love to know how you handle your finances so we can support each other.” This approach invites collaboration.

Discussing Debt

Debt carries a heavy stigma, but it is a reality for many Kiwis. When asking about debt, keep it factual. “If we are going to plan a holiday together, I think we should look at our budgets. do you have any monthly payments, like credit cards or car loans, that we need to factor in?”

Discussing Income

You don’t need to ask “How much do you earn?” directly if it feels too blunt. Instead, ask about lifestyle affordability. “I earn about $X per year, so I try to keep my rent under $Y. How does that align with your budget?” This naturally leads the partner to disclose their range.

Remember, the goal is not to judge the numbers but to understand the habits behind them. A partner with high debt who is aggressively paying it off is often a better long-term prospect than a partner with no debt who spends every cent they earn.

Splitting Costs Fairly: Equity vs. Equality

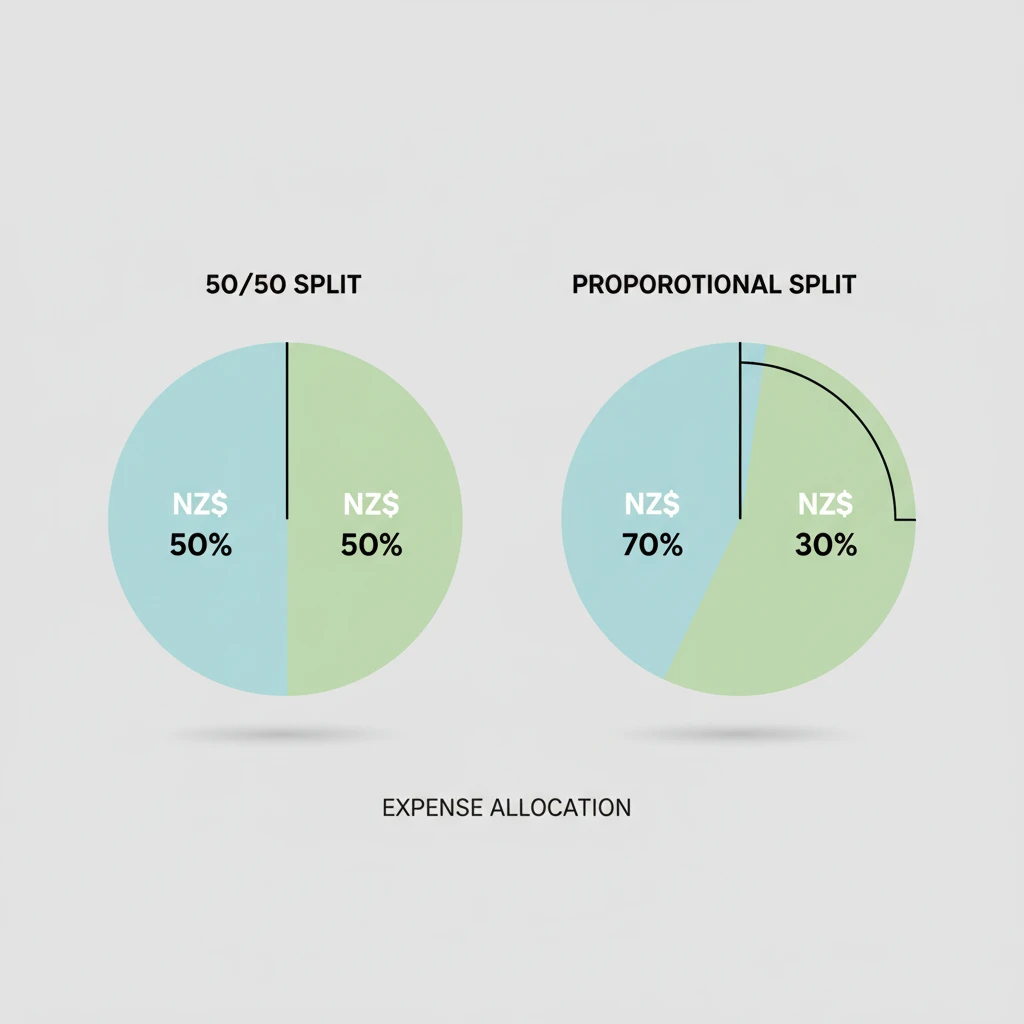

One of the most common friction points in modern relationships is how to split bills, especially when there is an income disparity. The old-fashioned notion of the man paying for everything is largely outdated, but the “50/50 split” can be equally problematic if one partner earns significantly more than the other.

The 50/50 Split

Splitting everything down the middle is simple and works well when incomes are similar. It fosters a sense of equality and independence. However, if one partner earns $120,000 and the other earns $45,000, a 50/50 split on a luxury apartment will bankrupt the lower earner while being negligible for the higher earner. This can breed resentment and power imbalances.

The Proportional Split (Equity)

A more equitable approach for serious relationships is the proportional split. Here, you contribute to joint expenses based on the percentage of total household income you bring in. For example, if you earn 70% of the total household income, you pay 70% of the rent and bills. This ensures that both partners feel the financial burden equally relative to their means.

The “Yours, Mine, and Ours” Method

Many couples find success with a hybrid banking model. Each partner keeps their own personal account, but both contribute to a joint account for shared expenses (rent, utilities, groceries). The amount contributed can be 50/50 or proportional. This method maintains a degree of autonomy—no one needs to ask permission to buy a coffee—while ensuring household obligations are met.

The Legal Reality: The Property (Relationships) Act 1976

In New Zealand, talking about money isn’t just about relationship health; it is a matter of legal protection. The Property (Relationships) Act 1976 is a powerful piece of legislation that catches many couples off guard. Under this Act, once you have been living together as a couple for three years, you are generally considered to be in a de facto relationship.

The implications are massive: in the event of a separation, the starting point for dividing “relationship property” is a 50/50 split. This includes the family home (even if one person owned it prior to the relationship, in certain circumstances), income earned during the relationship, and KiwiSaver contributions made during that time.

This reality makes the money conversation dating phase critical. If you are bringing significant assets into a relationship, or if you are taking on a partner with significant debt, you need to be aware of the legal consequences. Ignoring this can lead to devastating financial loss.

For couples who wish to opt out of the Act’s provisions, a “Contracting Out Agreement” (often called a prenup or Section 21 agreement) is necessary. While this sounds unromantic, it is a responsible way to clarify financial expectations. For authoritative information on how this law applies to your situation, you can refer to the New Zealand Ministry of Justice guide on dividing relationship property.

Financial Red Flags and Controlling Behavior

While most financial friction is due to different habits or lack of communication, there is a darker side to money in relationships. Financial abuse is a potent form of domestic control, often beginning subtly during the dating phase.

Warning Signs

- The Interrogator: A partner who demands to see your receipts for every small purchase or criticizes your spending habits aggressively.

- The Saboteur: A partner who actively interferes with your ability to work or study, thereby making you financially dependent on them.

- The Mooch: A partner who constantly “forgets” their wallet or experiences mysterious banking errors, leaving you to cover the bill repeatedly.

- The Secret Keeper: A partner who is evasive about where their money goes, refuses to discuss debt, or hides mail/bank statements.

It is vital to distinguish between privacy and secrecy. Privacy is having your own spending money that you don’t need to justify. Secrecy is hiding significant financial facts that affect the partnership. If you notice these red flags, it is rarely a matter of “working it out.” Often, it is a sign to exit the relationship before your finances—and your self-esteem—are entangled.

Moving Forward: Creating a Shared Financial Vision

Ultimately, the goal of the money conversation dating process is not just to avoid disaster, but to build a shared future. When two people align their financial energies, they can achieve far more than they could alone. Whether it is saving for a deposit on a first home, planning a dream wedding, or investing for early retirement, money is the tool that powers your shared dreams.

Start small. Celebrate small financial wins together. If you pay off a credit card, celebrate with a (budgeted) dinner. If you hit a savings milestone, acknowledge the teamwork required to get there. By normalizing money talk, you transform it from a source of anxiety into a source of strength for your relationship.

People Also Ask

When should you talk about money when dating?

You should begin discussing broad financial values within the first 3 months. However, specific details regarding salary, debt, and credit scores should be disclosed before becoming exclusive or certainly before moving in together to ensure compatibility and trust.

How do you split bills when one earns more in NZ?

In New Zealand, many couples opt for a proportional split rather than 50/50. This means each partner contributes to joint expenses based on the percentage of the total household income they earn, ensuring the lower earner is not financially overburdened.

What are financial red flags in a relationship?

Major red flags include secrecy regarding debt or income, controlling behavior over your spending, borrowing money without repayment, and extreme impulsiveness with large purchases without consulting the partner.

Does a de facto partner get half your assets in NZ?

Generally, yes. Under the Property (Relationships) Act 1976, after living together for three years, relationship property is usually divided 50/50 upon separation, regardless of who paid for it originally, unless a Contracting Out Agreement is in place.

How do I ask my partner about their debt?

Approach the topic with empathy and use “I” statements. Share your own financial situation first to build trust, then ask open questions like, “Do you have any monthly loan payments we should factor into our future budget plans?”

Is financial incompatibility a reason to break up?

Yes, financial incompatibility is a leading cause of divorce. If partners have fundamentally different values regarding saving, spending, and debt that cannot be reconciled through compromise, it often leads to resentment and relationship breakdown.